by halmin | Sep 11, 2025 | Blog

For many Canadians, buying a first home feels like both a dream and a challenge. Rising home prices and the high cost of living make it difficult to set aside enough money for a down payment. To help address this, the federal government introduced the First Home...

by halmin | Aug 18, 2025 | Blog

The Registered Retirement Savings Plan (RRSP) and the Tax-Free Savings Account (TFSA) are two of the most powerful investment tools available to Canadians. They both help you grow your savings faster by offering tax advantages, but they work in very different ways....

by halmin | Jul 17, 2025 | Blog

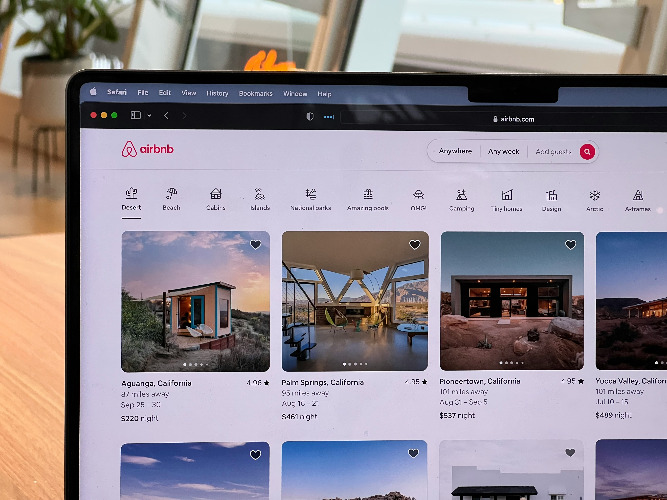

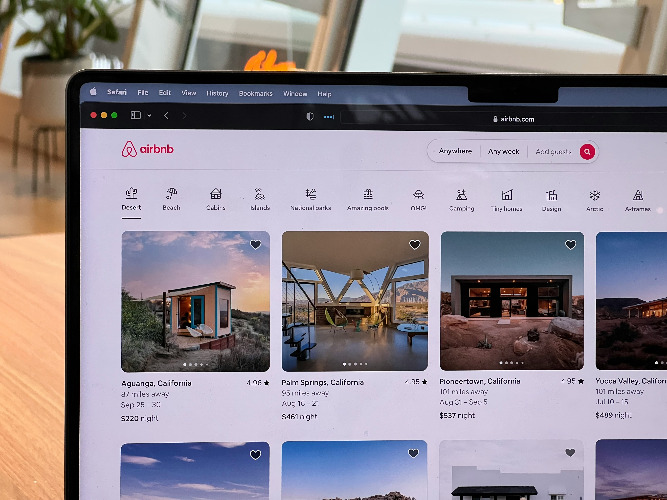

Short-term rentals like Airbnb have become a popular alternative to traditional hotels for business travellers across Canada. They often offer better rates, more flexible spaces, and the comfort of feeling at home, even when you’re away for work. But when it comes...

by halmin | Jun 18, 2025 | Blog

Summer is often a season of freedom—vacations, camps, outdoor adventures, and opportunities to learn or grow your business. But when the season ends and tax time rolls around, many Canadians are left wondering if any of those warm-weather expenses could help reduce...

by halmin | May 22, 2025 | Blog

For many Canadians, tax season is a time of paperwork, deadlines and, hopefully, a refund at the end of it all. If you’re expecting money back from the Canada Revenue Agency (CRA) this spring, you’re not alone. Each year, millions of Canadians receive tax...